Selling Your Apartment Building & Multifamily Properties

This post is about how to sell your commercial property. The focus will be apartment buildings, also known as multifamily buildings. Most of this information can be applied to any market, but some things are specific to Chicago.

Disclaimer *

Yes, this post is long; it is about a 13-minute read. However, for most people, this will be the largest transaction of their life. 13 minutes isn’t a bad trade-off for some excellent free information. Save the page and come back to it later if you are short on time, or click the section that interests you the most in the table of contents to skip ahead.

I’m a commercial real estate agent and the Sales Director at Root Realty. In 2022 Root was added to Inc. Magazine’s 5000 list of the fastest-growing, privately-owned companies in America. Seventy per cent of my sales are from apartment buildings, with the rest being development sites or mixed-use buildings. I’ve brokered millions of dollars of commercial sales, and leased over 100 units.

Educating owners is one of the most important aspects of my job, so let’s begin!

Table of Contents

Are Apartment Buildings Considered Commercial Properties?

- How the property is valued.

- Where/how it should be marketed for sale.

- The type of agent you hire.

- The type of lending that is allowed .

- Who the end buyer will be.

Understand Your Goals

What is your end goal? Sell for the highest possible price? Sell quickly? Sell without putting any additional money into the property? Sell with the least disturbance to your tenant? The list goes on. The end goal will dictate how to price and market the property. For example if you have a property that you want to sell at the highest possible price you will need to:

- Get the property in the best condition possible.

- Rental income should be high and expenses should be low.

- Be sure that financial performance is effectively conveyed to potential buyers.

- Be open to having it marketed widely.

- Expect to show the property to many qualified buyers.

- Prepare to be on the on the market for quite awhile.

- Hire a qualified broker.

Some of these things become less critical if your property is priced toward the middle or lower end of the market. When selling an apartment building, it is important to consult with an accountant about the tax implications. There could be capital gains taxes to consider or manage as the net proceeds are calculated.

Understand the Market

- Lending is different

- Buyers typically have to put 20% down

- The property’s ability to pay the loan back is huge factor

- Far more platforms market residential properties than apartment buildings or pure commercial properties

- More buyers are looking for homes to live in

- People don’t sell investment properties as often

- There’s less inventory overall

Understanding the market usually takes an agent’s help to pull recent comparable sales in the area. You can check public records to determine what a building’s price when last sold. Unfortunately, that will just give you the price, which is only part of the equation. However even without an agent there are other ways to stay informed such as:

- Be aware of interest rates

- Attend real estate events (most are free)

- Join your local neighborhood builders association (different cities have different names for these groups. A great place to start if you are in Chicago would be here – nboachicago.com/about-affiliates/

Prepare Yourself & Your Building for a Sale

- Rent Roll

- Income

- Expenses

- Major Capital Expenditures (major renovation work to the building, such as updated plumbing, new roof, updated electrical, etc.)

It isn’t the end of the world if you don’t have all those items, but it certainly helps.

Building Presentation – It doesn’t matter if you are showing the building to an appraiser, broker, or buyer. Make sure your building presents well. I don’t mean spending a lot of money fixing roofs or updating units. I’m talking about cleaning common areas such as basements, hallways, and landscaping.

How Do You Know What Your Property Is Worth?

To find out how much your property is worth, you can get an appraisal or a broker opinion of value (BOV). This is typically a free service agents offer to potential clients. If done correctly, it will have up-to-date/relevant market information for a sale.

An appraisal can be costly. Outside of the cost, appraisals can vary greatly based on what information an appraiser has access to or uses. Appraisals also don’t fully take into account current market nuances. Such as, if you are selling a 6-unit building in a neighborhood with many other 6 unit buildings for sale, that will impact pricing.

Finally, any appraisal you order typically will not be used by any other institution. Meaning that if you are looking to refinance your property or the buyer’s lender needs an appraisal, they will have to order their own.

Broker Opinion of Values are subjective, but so are appraisals. Save the money and have a couple of Broker Opinions of Value to figure out what your building can sell for. *A broker opinion of value is only as good as the broker providing it. For best results, use a broker that handles your type of asset.

How to find the right agent to sell your building?

- How would you market my property? This is probably the most important distinction between hiring an agent and doing it yourself. A good agent will have the experience to market your property and invest in the tools to market the property effectively. Such as local/national sales platforms, professional pictures/video, Offering Memorandum( OM Brochure with all relevant details for the property), etc. If you are curious about our process, click here – bit.ly/howrrsales

- What are some similar properties you’ve sold? Similar meaning size, type, price point, etc. If a brokerage or agent’s average deal size is 10 million dollars, are they a good fit for your one million dollar property? They could be, or their time and attention could be focused on their larger sales.

- Have you sold anything else in the area?

- How often will I be notified of progress?

It’s important to note that many owners don’t want people to know their building has sold. So sometimes, the best brokerage for you won’t have an active social media presence or show many listings on their website.

That’s slowly starting to change, but I have found that some owners hire residential agents to handle the sale of their property simply because they see their sign on houses or are more familiar with the brokerage name. There’s nothing wrong with picking a company you are familiar with, but you should also consider the broker/agent’s specialties as well.

What is a listing agreement?

A listing agreement is a contract signed by the owner and the agent that explains the terms of the agreement. Major portions of the listing agreement are:

- List price – The price an agent is instructed to list the property for.

- Length of time – In Chicago, a 6-month listing agreement is pretty typical.

- Commission – Who pays the commission? In Chicago, commissions are usually paid by the seller, and if the buyer has an agent, the broker typically shares that commission with them.

- Fees – Some brokers charge marketing fees

Where/How is Your Multifamily Building Being Marketed?

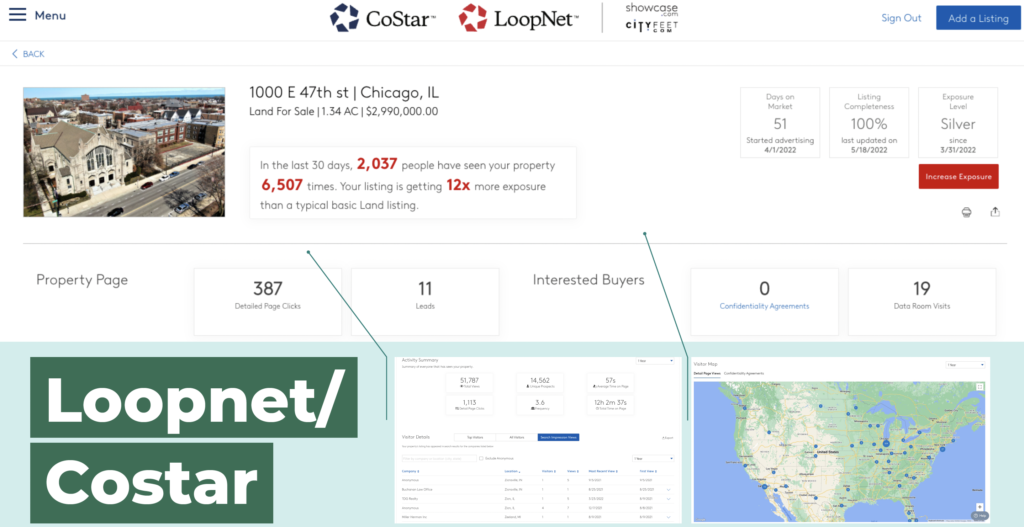

Different listing platforms have different success rates based on location, property type, and sales price. LoopNet is the leading national sales platform for commercial properties. In Chicago, you want access to LoopNet if you’re selling an apartment building with over five units and and/or a million dollar listing price. The same goes for mixed-use buildings or any other kind of commercial property.

If the building is 2-4 units, the broker should have access to the Multiple Listing Service (MLS). The MLS is what most people think of when an agent says they have a property on the market.

Each agent has their own rationale for using one tool over the other. For example, Loopnet is expensive, and some agents don’t want the added cost. Ask where it will be marketed and why when you are interviewing an agent.

A good agent will have a list of buyers and agents in their system who would like to purchase the type of property you are selling. Outbound calls to that highly qualified group is a great way to start the sales process. We are bombarded by so many emails and notifications it is easy for investors to miss out on a property that would be perfect for them. Never underestimate the power of calling a buyer directly.

Finally, agents don’t dictate the market, and neither do owners. Buyers do that. When selling investment properties, if there is no way to justify the pricing, the likelihood of it selling is very low. That doesn’t mean you are completely helpless.

Some things you can do to help you reach your goal:

- Be clear and realistic with your goals on pricing and timing

- Take care of the building

- Get documents in order, including rent roll income/expenses, major improvements, etc

- Make sure the building presents well by cleaning up common areas

- Guide you on pricing

- Marketing the property in a manner that aligns with your goals on pricing, timing, etc

- Effectively convey relevant information to prospective buyers Screen potential time wasters

- Help drive demand by creating leverage with timing, marketing, or other offers

Find the right attorney

Just because a cousin works at a law firm that handles compliance doesn’t mean they can handle a real estate transaction. Attorney fees range from 1-5k, which is typically paid at closing. For complex deals that require zoning changes or other intricate work, the charges will be more.

Offers and Stages of Contracts

Each major city typically has a sales contract that is often used in transactions from the local realtor association. If possible, use that contract. This is because real estate attorneys have seen this contract often, and, in the end, it will cut down on time and money for them to review it. Offers can be submitted verbally or in writing. Letter of Intent or LOI – is a written offer a buyer provides before the contract to get the proper terms to put into the contract.

Major portions of the contract are:

Price – How much are asking for the property?

Earnest Money (EM) – this is a deposit that is to be held while the property is under contract. One percent of the purchase price is common, but it really can be any amount. There is a second portion where the EM can be increased after the inspection and attorney review period are over. If the buyer does not cancel the deal within the allotted time given to them, they lose their earnest money. This isn’t always guaranteed.

Mortgage Contingency – This allows a buyer to remove themselves from a deal if the loan can’t be approved. If the property doesn’t appraise for the right amount or the interest rate the lender quoted buyer changes, the buyer can cancel the contract and get their earnest money back. Typically this is a 30-45 day timeline. The shorter the time, the better for the seller.

Closing Date – Apartment buildings usually take 45-60 days to close. If a buyer is asking for a longer timeline, there should be a good reason, such as zoning changes or a need for extra due diligence like soil testing.

Real Estate Taxes and Proration – Since property taxes in Chicago are paid in arrears (meaning you pay the previous year’s tax), the seller is responsible for their portion of the taxes up until the closing date, while the buyer is responsible for the remainder of the tax year.

Because the buyer will be purchasing the property with a tax bill that may not even be out yet, there is a section where they will state the percentage of the amount they would like the taxes to be prorated.

105-110% is typical. If the buyer believes the property is under-taxed, they may raise that amount. As a seller, you want the number as close to 100% as possible. Ask your attorney to clarify your exposure.

Inspection period – This is the time the buyer has to do a physical inspection of the property. This usually runs during the same time as the attorney review period. 5-10 days is a reasonable amount of time for an apartment building.

As the seller you want a shorter amount of time. That way the buyer has the pressure to get their inspection done and let you know if they find something that will cause them to ask you to lower the price, fix something, or cancel the deal altogether.

Inspections can be intense. Some inspectors will go to each unit and check everything. Environmental tests are uncommon for apartment building sales, but they do happen. Phase One and/or phase Two environmental tests involve checking the soil to see if there are any hazards beneath the property. The buyer pays for the inspection, meaning the inspector works for them. They are there to find out if there is anything wrong with the building.

Attorney Review Period – Again, this typically runs at the same time as the inspection period. The buyer’s attorney will ask for documents from your attorney, such as the contract, rent roll, expenses, leases, etc.

After the inspection, the buyer will let the attorney know if there is anything of concern. The buyer’s attorney will email your attorney with specifics that will keep the deal moving forward. If there are any issues, the buyer’s attorney will ask for modifications to the contract, such as a price change, credit, or request to fix something. Keep your agent in the loop as they will be important as this process progresses.

Sometimes attorneys ask for an extension for the attorney review. If it’s a reasonable request, approve it. Once the attorney review and inspection period is over, there needs to be a signed document from both attorneys stating that it is over

Negotiations

When negotiating, you want to give the buyer a realistic timetable, but you don’t want your property under contract for an unreasonable amount of time. Also price isn’t the only thing you need to pay attention to. For example:

Offer One – 1.2 million with a 90-day close, 60-day mortgage contingency, 15-day inspection/attorney review period

Offer Two – 1.1 million with a 30-day close, no mortgage contingency, and a 5-day inspection/attorney review period.

A seller would consider the second offer because it has a higher chance of closing. At a minimum direct your agent ask to ask for highest and best offers. This means each party needs to resubmit their offer with their highest price and best terms. There’s a possibility the buyer with the higher price point will have better terms or come up with a higher price point that will make that extra risk worth it.

Even if the offer Two doesn’t change their offer, you, as the owner, must measure the risk. If you don’t mind putting the property back on the market, if the offer One falls through, go for it. Just remember that a buyer may move on to another property or submit an even lower offer if the property returns on the market.

Conclusion

Selling a building may seem like a daunting task, but it isn’t rocket science. Having the right agent guide you through the process makes things much easier. However, it is possible to get it done on your own.

If you have any questions about selling a multifamily building in Chicago and would like a free consultation, please click this link – bit.ly/contactroot

If you’d like to stay informed, subscribe to our newsletter to be notified when other helpful blog posts come up. Click this link – bit.ly/rrealtynewsletter